What an Emergency Fund Actually Covers

Life doesn’t announce itself before it flips the table.

Maybe it’s a midnight ER visit, a job layoff with rent due, or your only car refusing to start the morning of a school recital. Emergency funds are built for these exact moments real life, high stress disruptions you can’t plan for but still have to handle.

Doctors don’t wait for payday. Neither do mortgage lenders or mechanics. Having at least a small cushion just enough to give yourself a window can make the difference between picking up the pieces calmly or spiraling into panic mode.

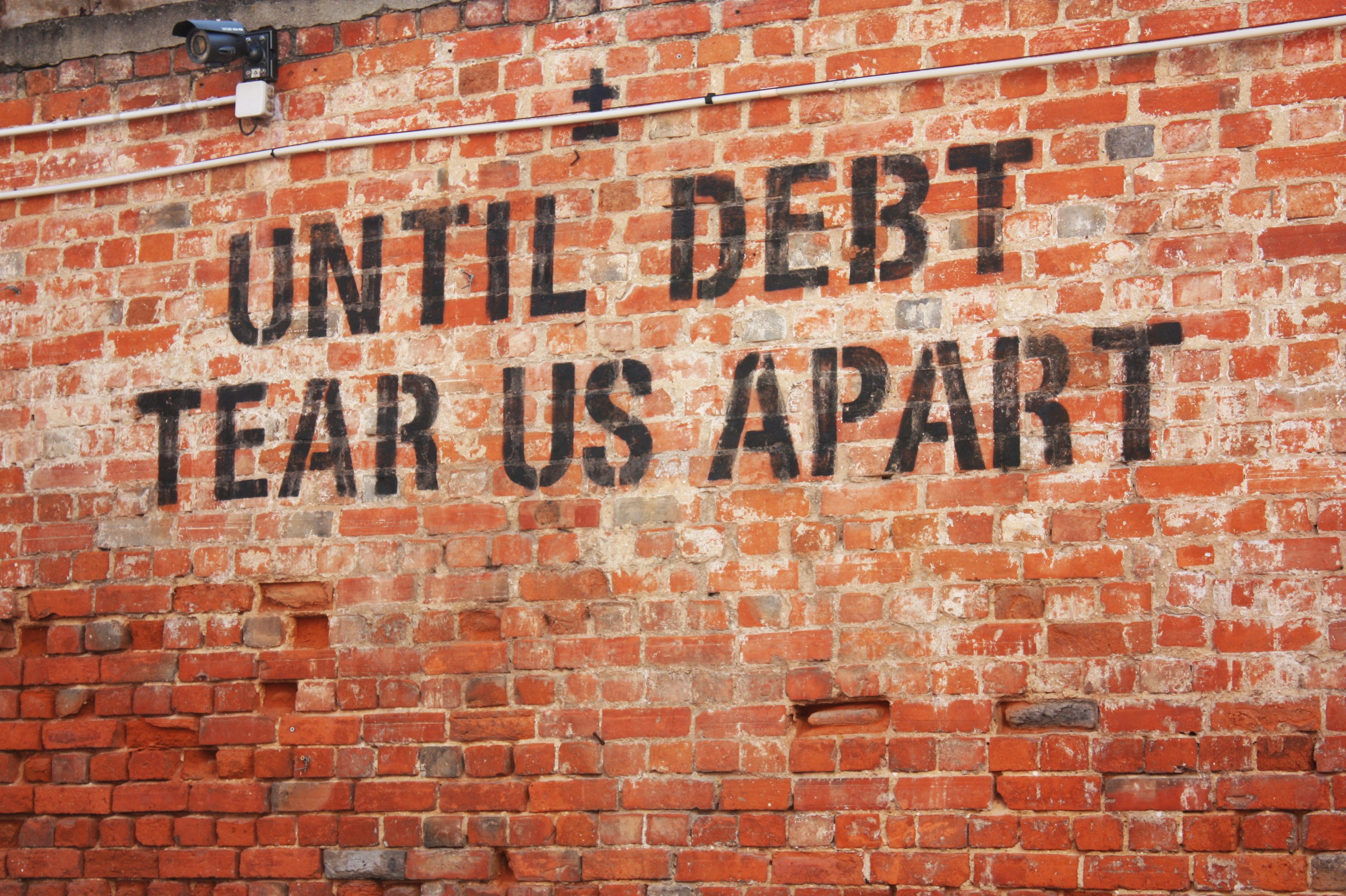

And no, credit cards don’t count. Relying on high interest debt turns short term problems into long term ones. Sure, a card might keep your lights on today, but it’ll keep you up at night three months from now. That’s not a plan. That’s debt in disguise.

An emergency fund isn’t just money. It’s peace of mind. It’s knowing your family can take a hit without unraveling. In an unpredictable world, a small safety net isn’t a luxury it’s basic survival.

How Much Your Family Really Needs

The old 3 6 months rule is a solid place to start. It means setting aside enough to cover your essential expenses think housing, groceries, insurance, and transportation for three to six months. But it’s not a fixed number for everyone. Tailoring it starts with knowing your reality.

If your household has two steady incomes and no kids, three months might be fine. But if you’re single income or have little ones, lean toward six. Got high interest debt, like credit cards or loans? Factor that in too it eats away at your cushion fast if something goes wrong.

Start by calculating your bare bones monthly budget. That’s not your current spending with takeout and streaming; it’s what you need to keep the lights on and food on the table. Go line by line: rent or mortgage, utilities, insurance, gas, groceries, debt minimums. Total it up. That’s your monthly baseline. Multiply by 3 6 based on your situation, and you’ve got your goal.

It’s not about hitting that number overnight it’s about understanding the target. Then build toward it, step by step.

Finding the Money to Start Saving

You don’t need a perfect budget or major life changes to start building your emergency fund. Start small, and start smart. Begin with what you already spend.

Look for low effort wins. Cancel subscriptions you forgot you had or only kind of use. Streaming services, apps, gym memberships if it doesn’t serve your daily life or peace of mind, cut it loose. Call your service providers and renegotiate bills. You’d be surprised what a quick phone call to your internet or phone company can do. Loyalty rarely gets rewarded unless you ask.

Now hit the grocery list. Meal planning isn’t glamorous, but it works. Know what you’re making each week. Shop off the list. Avoid impulse buys. And if you can swing it, carpool to cut fuel costs. “Little things” stop being little when you’re doing them every week.

Then, when a windfall lands tax return, work bonus, cash gift don’t let it vanish in the everyday churn. Put a chunk straight into your emergency fund. Even half makes a difference. These bonus boosts are how you build momentum without feeling the pinch.

The goal here isn’t to overhaul your life overnight. It’s to start where you are and move in the right direction. Every bit counts.

Prioritize by Reducing Family Debt First

Tackling high interest debt and building an emergency fund aren’t competing priorities they work better together. Why? Because interest heavy loans (like credit cards) eat into your cash flow every month. The more you’re paying toward interest, the less you have left to save. Freeing yourself from that pressure opens the door for faster, more consistent saving.

Start with the debts costing you the most: credit cards, personal loans, and payday advances. As those balances shrink, you’ll notice you can redirect that money into your emergency fund without needing to squeeze your budget any tighter. It’s not easy, but it’s clean: less debt, more breathing room.

If you’re unsure how to tackle family debts efficiently, check out this helpful guide on how to reduce family debt.

Best Ways to Store Your Emergency Fund

Your emergency fund isn’t meant to grow fast it’s meant to be there when you need it. That’s why you should keep it liquid. Translation: stick it in a high yield savings account where it earns some interest but stays accessible. This is not the place for stocks, crypto, or anything that swings with the market.

Keep the money separate from your checking account. Out of sight, out of mind. Tucking it away in a different bank or at least a different account helps you avoid dipping into it for non emergencies.

Start with automation. Set up small, regular transfers weekly or monthly based on what you can afford. You don’t need to hit the full goal right away. Just build the habit and let the account grow while you focus on everything else. No pressure, just progress.

Staying Consistent Without Burnout

Saving for an emergency fund is a long game. It’s easy to start strong and lose steam, especially when life gets hectic. That’s why regular check ins matter. Once a month or at least once a quarter sit down and look at how much you’ve set aside, what’s changed financially, and whether you’re on track. These quick audits keep your goals visible.

Don’t go it alone, either. Bring your partner and even your kids into the process. It’s not just an adult problem financial resilience is a family value. When everyone’s invested in the why, it’s easier to stay disciplined.

And celebrate the little wins. Hit your first $500? Mark it. Got to half your goal? Do something fun but modest to acknowledge the progress. It keeps momentum up and reminds you that this isn’t just about saving. It’s about building security, together.

Final Word: Make It a Lifestyle Shift

Emergency funds aren’t a bonus they’re the baseline. Life throws punches without warning. When it does, that cushion keeps your family upright. Too many people wait for “extra money” to appear before they start saving. Here’s the truth: it rarely does. Start where you are. Even a few dollars a week can snowball if you stay with it.

Early progress matters more than perfect planning. Build the habit before you build the full fund. Cut what you can, stash what you save. As debts fall, shift that freed up money directly into your safety net. Minimal stress, slow and steady.

This isn’t a one time goal it’s a shift in how you handle money. Small steps. Real changes. More peace.

Set it. Guard it. Grow it.